The meat alternate options market has attracted an inflow of funding lately. In keeping with figures from the Good Meals Institute, the choice protein sector secured US$14.2 billion in personal capital over the previous decade, with annual investments practically doubling yearly to 2022.

A growth in innovation has adopted, with meals scientists working to develop plant-based merchandise that mimic the style, texture, and aroma of meat.

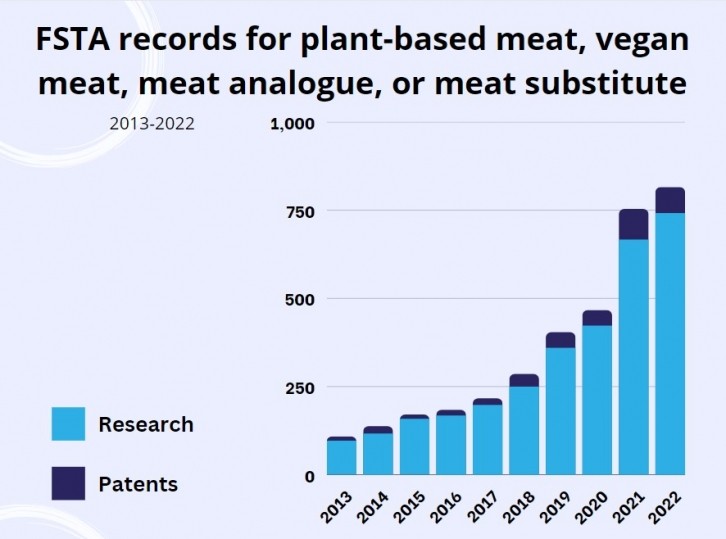

That is evidenced by the bounce within the scientific literature and patent filings listed within the Meals Science and Expertise Abstracts (FSTA) database produced by instructional not-for-profit IFIS Publishing.

The database is utilized by meals researchers at main tutorial establishments, authorities organisations, and meals companies together with Nestlé, PepsiCo, Coca Cola and Basic Mills. In whole, FSTA incorporates 6224 data associated to plant-based meat and meat substitutes, with a transparent acceleration in revealed materials during the last decade. In 2022, 815 analysis papers and patents have been listed, up 277% from the quantity 5 years earlier than.

Plant-based meat: A class on a cliff edge?

This hive of R&I exercise has translated right into a plethora of product launches.

Within the meat analogue fixture, corporations have leveraged meals science to face out on the more and more crowded shelf, offering a defensible mental property place that delivers a singular promoting level. Over the 5 years to 2022, the variety of patent filings within the FSTA database rose by nearly 290%.

As meals innovators have rushed in to fill a perceived demand for meat analogues the class has change into saturated. In such a circumstance, you’d usually count on a shakeout as corporations that don’t make the lower fall by the wayside. What has shocked many commentators is the extent to which now we have seen big-name manufacturers wrestle to hook up with customers.

Past Meat turned the newest high-profile casualty of lacklustre gross sales within the plant-based sector final month, when the group reported income fell by 31% within the three months to the top of June.

In its quarterly monetary replace, the plant-based pioneer – the primary to supply burgers that seem to ‘bleed’ – noticed it had been hit by ‘softer demand within the plant-based meat class, excessive inflation, rising rates of interest and ongoing considerations in regards to the chance of a recession’.

Past Meat is way from the one plant-based model feeling the pinch.

Monde Nissin, the Filipino meals big that owns mycoprotein maker Quorn Meals, cited ‘continued class challenges’ when it reported an 8.8% drop in gross sales at its meat various enterprise final quarter. However, regardless of the lower, the group was fast to emphasize Quorn elevated its UK market share.

Certainly, Quorn is the beneficiary of market consolidation within the UK, a rustic the place plant-based gross sales have declined by 6%. Much less lucky smaller rivals like Meatless Farm and Plant & Bean have needed to name within the directors.

What’s behind the decline?

Pundits counsel inflation and the price of dwelling disaster are serving to take plant-based meat gross sales off the boil. Whereas consumers would historically cut back meat and dairy consumption to decrease grocery payments, it transpires swapping them out for plant-based alternate options is definitely costlier.

Plant-based meat makers striving to achieve important mass are struggling to safe value parity towards a competitor within the meat business that has been laser-focused on effectivity, margin and volumes for many years. Nielsen information demonstrates that, on common, plant-based meat is 2x as costly as beef, greater than 4x as costly as hen, and greater than 3x as costly as pork per pound.

In a current shopper survey revealed by Mintel, 34% of respondents stated value is a barrier to buy. Finances-conscious customers are much less more likely to attempt new meals – and that is most likely all of the extra true as a result of plant-based meat alternate options proceed to wrestle with different reputational points.

Mintel’s analysis highlighted ongoing challenges round organoleptic efficiency, with 48% of customers reporting concern over the style and flavour of plant-based meat alternate options and 24% citing texture points as a purpose to not purchase.

“Plant-based meat various gross sales have slid from their peak in 2020 as customers abandon the class in favour of inexpensive protein choices. The class continues to wrestle with damaging perceptions even amongst those that comply with a lowered meat eating regimen,” defined Caleb Bryant, affiliate director of foods and drinks stories at Mintel.

The science supporting plant-based meat

The plant-based meat sector is one that’s rightly characterised as meals tech ahead.

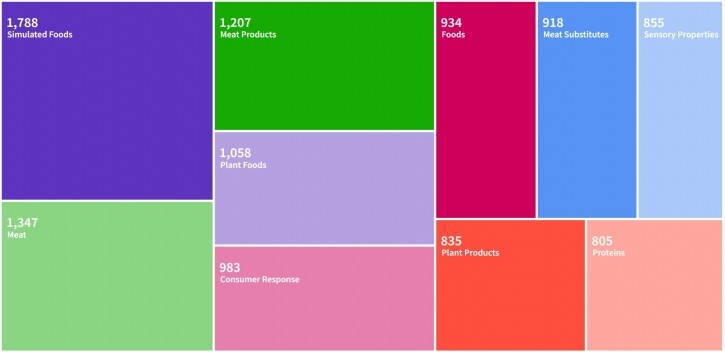

Researchers have been grappling with the sensory challenges of meat mimicry, as evidenced by an evaluation of the highest descriptors inside FSTA’s content material on meat analogues. Among the many most typical index phrases will be discovered ‘shopper response’ and ‘sensory properties’.

If we drill down into analysis on sensory properties, it turns into clear the place the key challenges lie. Key phrase analyses reveals meals researchers are concentrating on enhancing the organoleptic properties of plant-based meat, with a specific give attention to bodily properties, texture, flavour and color.

Based mostly on Mintel’s shopper analysis, it appears extra work is required to supply an consuming expertise to problem shopper perceptions that plant-based meats don’t ship on style and texture.

Additionally it is telling that the commonest descriptor occurring in FSTA’s catalogue of plant-based meat analysis is ‘simulated meals’. Barely additional down the checklist of widespread phrases will be discovered ‘processed meals’, a descriptor that occurred 714 instances, whereas ‘processing’ cropped up on 698 events.

This displays the extent of processing required to take a plant protein and remodel it into one thing that delivers an consuming expertise akin to animal protein. Nevertheless it additionally presents a core class problem.

As an evaluation of IFIS Publishing’s Plant-Meals Database reveals, well being and diet are trending areas of plant-based examine. Well being considerations have been as soon as thought-about a prime promoting level for the plant-based meat sector. At the moment, well being is changing into one thing of a hurdle as a result of associations with excessive ranges of processing.

Given the rising pushback we’re witnessing towards ‘processed meals’ within the standard creativeness, it’s maybe not shocking that Mintel discovered a fifth of consumers (21%) consider meat substitutes are ‘too processed’, whereas 35% say meat is a greater supply of diet.

Meat analogue makers are caught between a rock and a tough place. Additional analysis into substances and processing applied sciences is required to supply plant-based merchandise that higher imitate meat. However on the identical time, a rising cohort of customers declare to reject the very processes that make meat mimicry doable.

You possibly can’t please all of the folks on a regular basis. However will the meat substitute sector have the ability to please sufficient folks, sufficient of the time, to make sure a thriving future for the class?