Client behaviour advisory firm Circana unveiled its newest meals business insights, detailing altering client spending patterns and gross sales of fast-moving client items (FMCG).

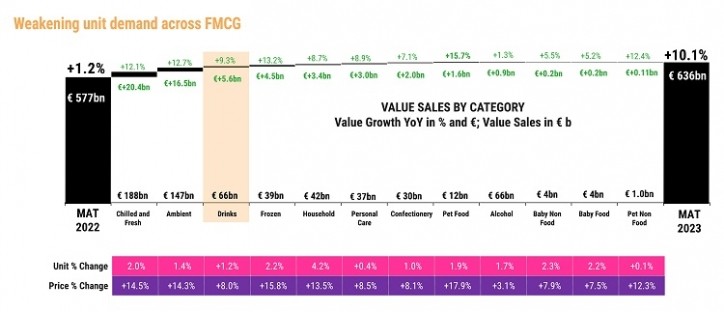

In its newest FMCG Demand Alerts report, Circana knowledge reveals that FMCG worth gross sales proceed to be pushed virtually fully by inflation, which has grown by an extra 10.1% year-on-year (YoY) to succeed in €636 billion. There may be weakening unit demand throughout FMCG that isn’t anticipated to get better earlier than the second half of 2024 as European customers proceed to purchase much less, with a 1.3% decline in unit gross sales over the previous 12 months.

“Inflation-fatigued customers are favouring discounted and deal-driven procuring,” Ananda Roy, International SVP, Strategic Progress Insights, Circana, informed FoodNavigator. “Regardless of these challenges, prospects for progress and resilience lie in innovation, sustainability, and strategic pricing methods to resist future shocks,” Roy added.

In the present day’s meals business is going through “a brand new period in pricing”, Roy mentioned. On this period of shifting client loyalties, producers and retailers should reevaluate their pricing methods to reinforce demand, safeguard quantity, and obtain unit progress. Meals and beverage manufacturers must undertake a contemporary method to pricing, avoiding adjustments that erode margins with out producing appreciable quantity will increase. “The looming risk of a value struggle underscores the significance for manufacturers to keep away from a race to the underside,” Roy detailed.

Evolving client buying habits

The report revealed that at this stage within the cost-of-living disaster, customers have adopted a variety of behaviours to reasonable the influence of rising costs. Procuring round, shopping for smaller packs of meals, shopping for extra from discounters and being sensible about offers are in style methods as we speak’s customers are procuring.

Shoppers are additionally extremely price-focused when making an attempt merchandise. Subsequently, if a product shouldn’t be on sale or obtainable at a horny value, they’ll purchase one other model, change to a private-label possibility or transfer to a unique retailer altogether.

There may be additionally proof that classes, merchandise, and even out-of-home consumption as soon as thought-about ‘on a regular basis’ at the moment are seen as discretionary by customers. “This doesn’t imply they’re not purchased in any respect,” Roy mentioned. As an alternative, extra usually, a product turning into discretionary suggests customers are shopping for much less of it, making what they’ve of their cabinets last more or deferring their buy.

“All of those coping behaviours—shopping for extra from discounters, switching to personal label manufacturers and shopping for solely important gadgets—will solely go up to now, although,” Roy mentioned. Continued unit decline not solely sees customers procuring in a different way, however additionally they should make troublesome decisions about what they’ll and may’t afford each time they store. “Typically, the one inexpensive possibility open to them is to devour much less, notably since inflation remains to be centered on on a regular basis meals gadgets,” Roy added.

Difficult client traits set to proceed

Projections point out that the pressures customers face in making buying selections will proceed for the foreseeable future. “As international turmoil and uncertainty proceed, lots of the difficult client traits and behaviours we’ve got seen during the last two years are set to proceed for an additional 12 months,” Roy shared.

Inflation has eased significantly in latest months. Nonetheless, this may usually be anticipated to result in a restoration in demand. “That unit gross sales have continued to drop reveals how financially distressed customers are and the way basically the cost-of-living disaster has modified their procuring habits,” added Roy.

A number of components clarify why demand has remained unexpectedly weak, the report discovered. Whereas enterprise confidence and client sentiment have improved previously six months, companies inflation has begun. “Sky-high insurance coverage prices, rents and mortgage rates of interest are squeezing incomes in nominal phrases,” Roy shared.

Current information about meals costs easing additionally must be put into context, Roy mentioned. Whereas FMCG value inflation is lowering, costs stay a lot greater than in January 2021. As flagged in Circana’s earlier Demand Alerts report, ‘disinflation’ drives class pricing reasonably than deflation. “The online impact is that European customers proceed to really feel a lot worse off than they did two years in the past,” Roy mentioned.

Shedding market share and gaining it again once more

Meals and beverage manufacturers are lacking market income as a result of non-public labels proceed gaining floor, the report states, which follows the rise of grocery store non-public label manufacturers and fewer new product launches. Circana’s final Demand Alerts report 2023 flagged a ‘tipping level’ for personal labels and indicated that European customers more and more understand it as the standard alternative. Six months on, the march of personal labels continues. “What’s extra, non-public labels have gotten more and more premium,” added Roy.

Now accounting for 39% of grocery gross sales within the European Union (EU), the non-public label phase is value €246 billion to retailers, having grown its worth share by an extra 2.2 share factors within the final 12 months, to June 2023. Two years in the past, that share stood at 35%.

Nonetheless, private-label growth shouldn’t be anticipated to proceed. “It’s essential to notice that there will probably be a restrict to personal label progress,” Roy shared. In as we speak’s European retail atmosphere, retailers, like manufacturers, are the most important drivers of worth, innovation and footfall. Retailers need non-public labels to compete vigorously with manufacturers however don’t need manufacturers to fail.

“Non-public labels have to be thought to be severe competitors, and types should establish sources of progress and alternative, notably within the areas of innovation, sustainability and pricing, and enhance their resilience to future shocks,” mentioned Roy.

Now’s a tricky atmosphere to take action, nonetheless. “Creating new demand is way from straightforward proper now, however our evaluation reveals it may be achieved,” Roy shared. Intuitive, well-targeted innovation sits on the coronary heart of a model success story and pushing onerous on new product growth (NPD) provides customers contemporary causes to attach with a meals and beverage class.

Trying forward, the main focus, the report asserts, is on inspiring customers and positioning merchandise as versatile substances that can be utilized to create thrilling meals.

“Over the subsequent 12 months, the successful manufacturers will put money into daring, agenda-setting NPD that responds to new client behaviours and consumption moments, not those that tinker across the edges of their portfolios,” Roy added.